Blog

GCP allows you to keep flexible statistics, customizing it for yourself and for the specifics of your business (regardless of its type and size). As a result, it simplifies the accounting.

Each incoming payment from your client can be identified by giving it an individual number, which will distinguish it from all other payments and simplify the work with statistics.

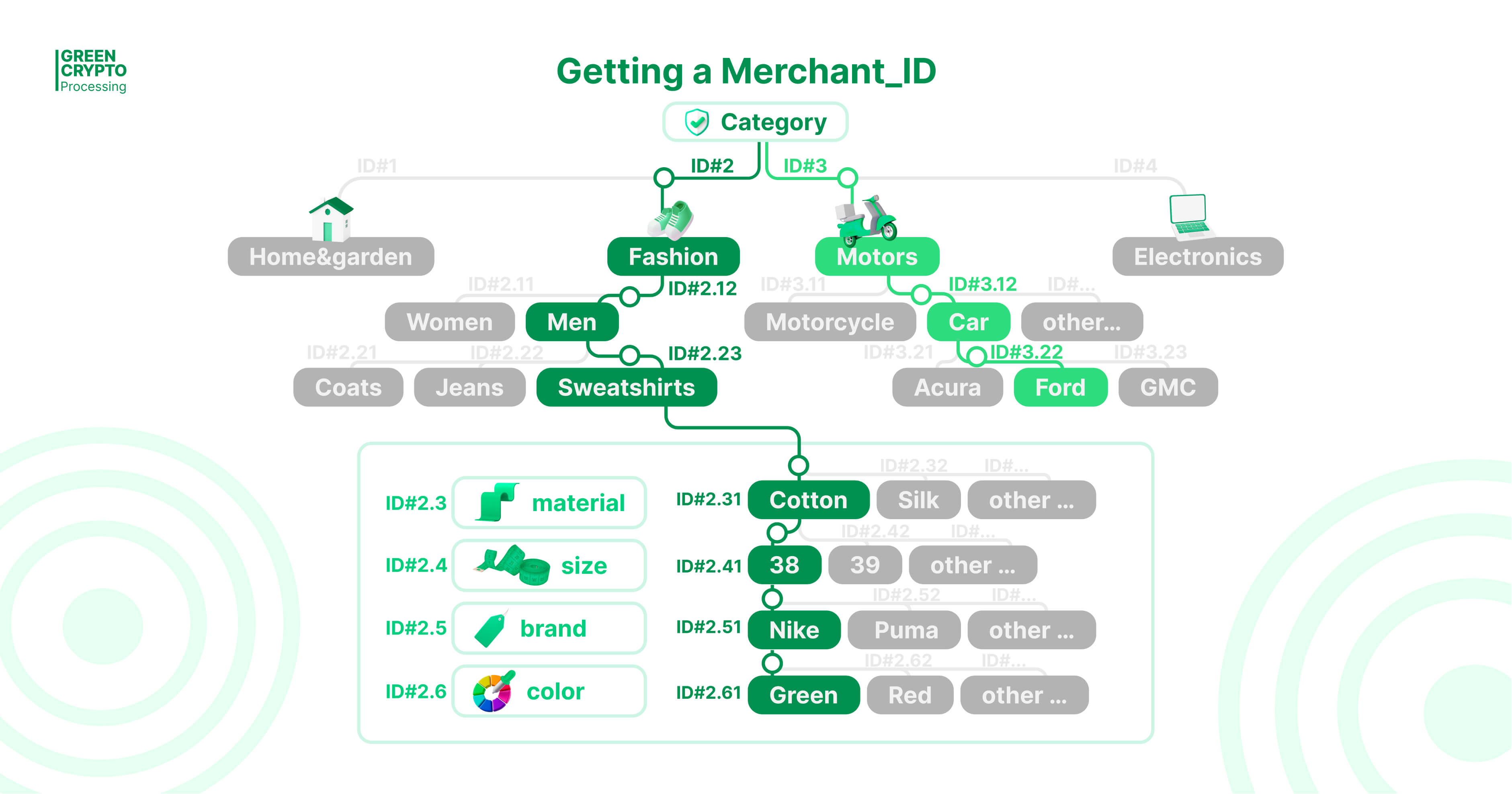

merchant_id is the merchant identifier in GCP. Using it, you can distinguish one item from another, "collect" groups of them and combine them into categories by various features.

merchant_id can be:

- the same (each new payment address will be "attached" to the previous id);

- different every time (each new payment address will be "attached" to a new id).

Marketplace

Let's go back to the example with a marketplace with a wide range of products (eBay, Amazon format). Using merchant_id we can identify, for example (see pic.):

- product category (clothing);

- group of products (men's clothing);

- basket of goods (when we want to see that the customer has purchased several products at once, for example, a sweatshirt + a care product);

- product (sweatshirt);

- product configuration (brand, color, size, material, delivery time).

Marketplace. merchant_id helps to identify the payment and keep statistics

If you have only one product line (for example, Reebok sneakers), you can also divide them into several groups for convenience by assigning different IDs accordingly:

- to gender (male/female);

- to models;

- to size;

- to suppliers (if you purchase from different factories);

- to size of the margin (which this or that model brings you).

How much more convenient is it?

merchant_id has the core function as an identifier of API (Transfer/Standard) and payment fee (fix/percent), as well as the support function: it can be used as an identifier of all other characteristics of a particular payment to simplify the work and the keeping statistics on it.

So, if you use the full set of APIs and fees (2 APIs and 2 fees), you will have only 4 merchant_id (one for each of the options), and payments within each of them will not differ from each other but by different payment addresses. If you want to divide payments into categories and subcategories and divide them by products automatically — there will be more merchant_id.

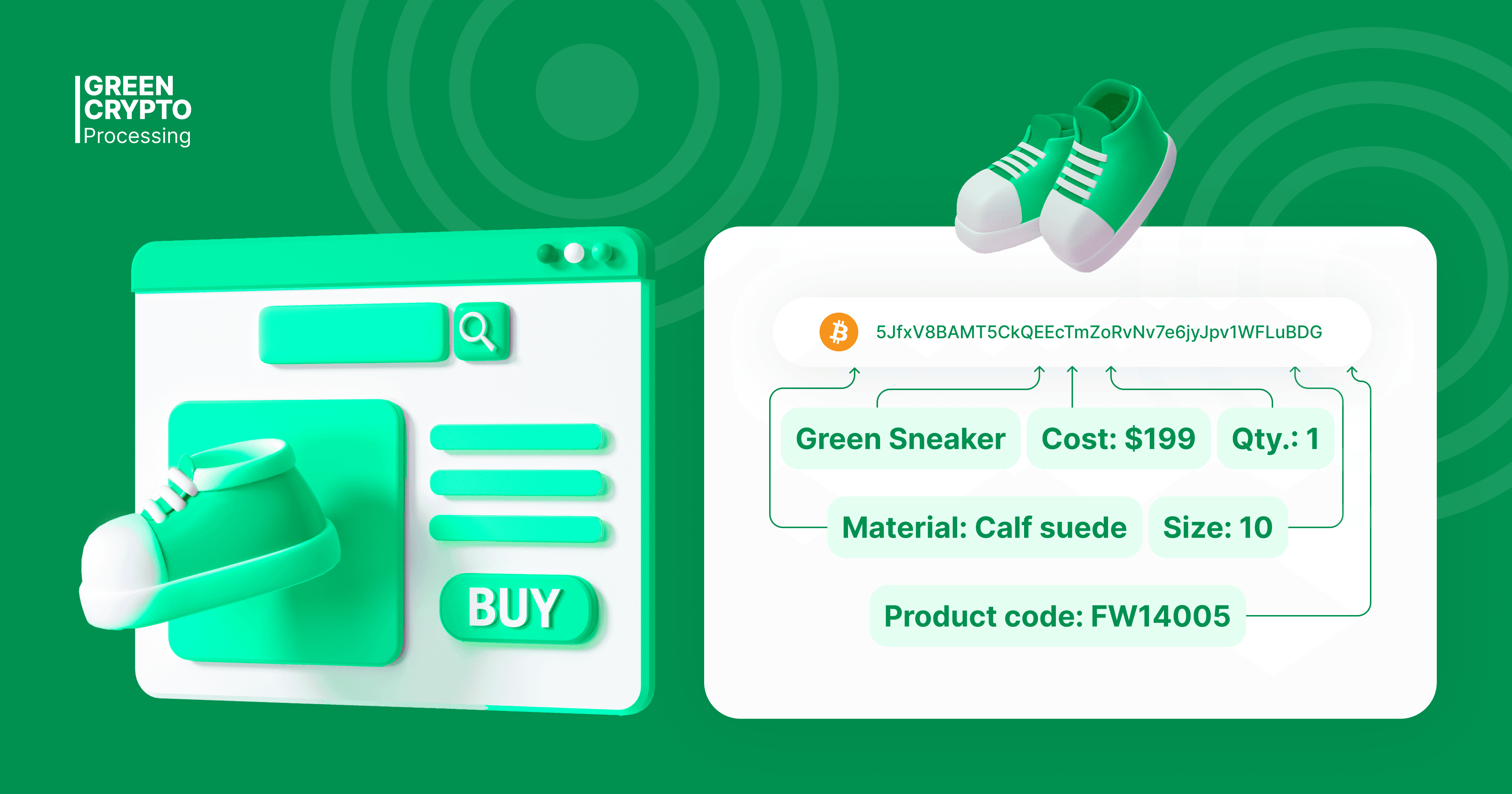

Thus, 2 options are available to you:

- "attach" all product characteristics (price, size, color, model, etc.) to the payment address only (see pic.), which is issued in response to a request where you specify the merchant_id (in this case, it is the same, permanent);

- or use an additional identifier that simplifies the work with payments by dividing them into categories according to different features.

Of course, in your accounting system you will still have to "attach" all the characteristics of the product to the payment address, store this data, filter and work with the list of products in a way comfortable for you.

Therefore, merchant_id is an additional "filter":

- thanks to which payments can be identified and summarized, simplifying work with statistics;

- which is located inside the GCP architecture and is part of the requests in the same way as the payment address;

- on the basis of which it is easy to get statistics on payments.

It is similar to the well-known summary tables of MS Excel, where by entering all the metrics for a product into one common table you can effectively compile statistics for different categories and make new insights based on those features that you set by yourself and that are important to you.

merchant_id as a "collection point" or a tool for maintaining all statistics in GCP

In response to a request for statistics on merchant_id you will receive all the data on payments that is "attached" to it:

- general data (consolidated): API type (Transfer/Standard) and fee type (fixed/percent);

- detailed data: payment addresses, transactions (with status: "executed", "not executed", "canceled"), transfer amounts, and so on.

So you can easily check, for example, how much funds have been credited in the previous month for a particular product or a group of products, whether it's a Ford car or a set of blue stationery.

We recommend to make several simple merchant_id templates to check general or detailed statistics on products "from top to bottom" when sending requests:

- general (for a group of products);

- detailed (for a specific product, taking into account all its configurations).

And, perhaps, you will be able to do this even faster than in your CRM or Excel, as the response time in GCP is only 100 msec.

Using merchant_id as a payment identifier makes statistics more flexible, allowing you to distinguish payments from each other.